Property Tax Sanders County Montana . Stage two fire restrictions in effect. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. The treasurer’s office is the collection and distribution center for all taxes in sanders county. Stage two fire restrictions for sanders county is in effect. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. To access your property information, enter a property number, assessment code, name, or address in the search box above. While the vast majority of taxes are paid on or. Check the characteristics of your property with. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. The department’s property assessment field offices are responsible for providing the total taxable. 2024 certified property taxable values.

from diaocthongthai.com

The department’s property assessment field offices are responsible for providing the total taxable. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. The treasurer’s office is the collection and distribution center for all taxes in sanders county. Stage two fire restrictions for sanders county is in effect. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. 2024 certified property taxable values. While the vast majority of taxes are paid on or. Check the characteristics of your property with. Stage two fire restrictions in effect.

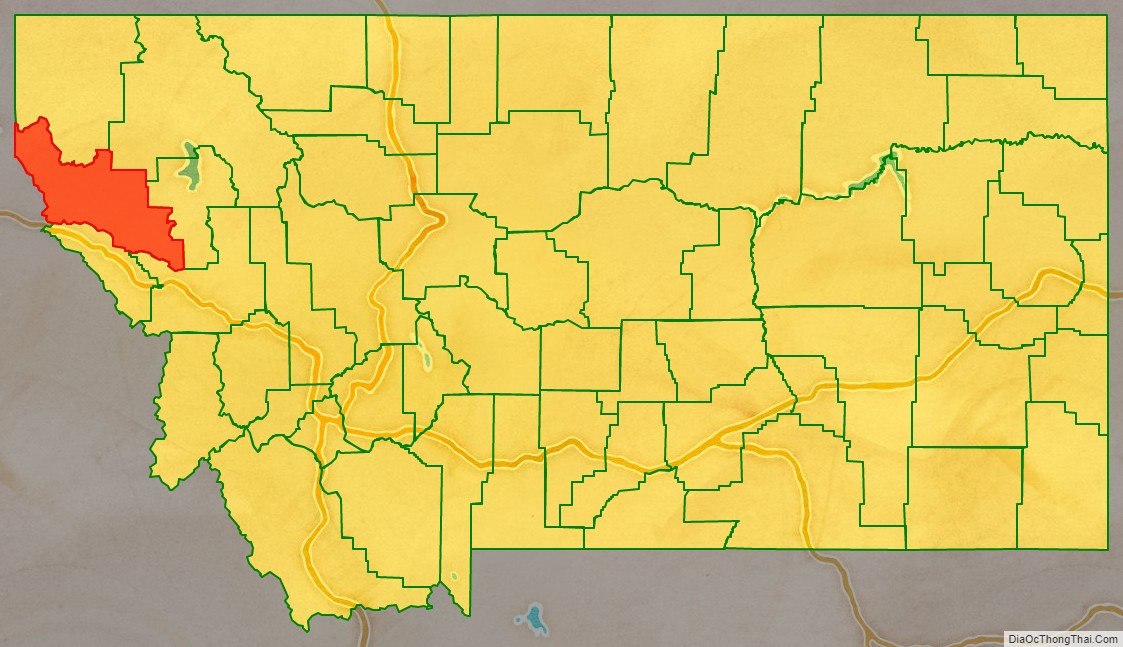

Map of Sanders County, Montana Địa Ốc Thông Thái

Property Tax Sanders County Montana 2024 certified property taxable values. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. Stage two fire restrictions in effect. Check the characteristics of your property with. Stage two fire restrictions for sanders county is in effect. The treasurer’s office is the collection and distribution center for all taxes in sanders county. To access your property information, enter a property number, assessment code, name, or address in the search box above. The department’s property assessment field offices are responsible for providing the total taxable. While the vast majority of taxes are paid on or. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. 2024 certified property taxable values. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500.

From www.landwatch.com

Plains, Sanders County, MT House for sale Property ID 335260373 Property Tax Sanders County Montana Stage two fire restrictions for sanders county is in effect. 2024 certified property taxable values. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Stage two fire. Property Tax Sanders County Montana.

From www.landwatch.com

Trout Creek, Sanders County, MT House for sale Property ID 414613860 Property Tax Sanders County Montana The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Check the characteristics of your property with. Stage two fire restrictions for sanders county is in effect. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. 2024 certified property. Property Tax Sanders County Montana.

From www.atlasbig.com

Montana Sanders County Property Tax Sanders County Montana Stage two fire restrictions in effect. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. The department’s property assessment field offices are responsible for providing the total taxable. The. Property Tax Sanders County Montana.

From www.landwatch.com

Plains, Sanders County, MT House for sale Property ID 334904533 Property Tax Sanders County Montana While the vast majority of taxes are paid on or. Check the characteristics of your property with. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. To access your property information, enter a property number, assessment code, name, or address in the search box above. The sanders county assessor is. Property Tax Sanders County Montana.

From www.landsofamerica.com

1.88 acres in Sanders County, Montana Property Tax Sanders County Montana The treasurer’s office is the collection and distribution center for all taxes in sanders county. To access your property information, enter a property number, assessment code, name, or address in the search box above. 2024 certified property taxable values. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. The department’s. Property Tax Sanders County Montana.

From store.avenza.com

Sanders County Montana map by Sanders County, Montana Avenza Maps Property Tax Sanders County Montana The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. To access your property information, enter a property number, assessment code, name, or address in the search box above. Stage two fire restrictions in effect. The treasurer’s office is the collection and distribution center for all taxes in sanders. Property Tax Sanders County Montana.

From www.land.com

470 acres in Sanders County, Montana Property Tax Sanders County Montana 2024 certified property taxable values. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. While the vast majority of taxes are paid on or. The treasurer’s office is the collection and distribution center for all taxes in sanders county. Stage two fire restrictions in effect. The median property. Property Tax Sanders County Montana.

From www.landsofamerica.com

393 acres in Sanders County, Montana Property Tax Sanders County Montana While the vast majority of taxes are paid on or. The department’s property assessment field offices are responsible for providing the total taxable. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Check the characteristics of your property with. Stage two fire restrictions in effect. To access your. Property Tax Sanders County Montana.

From diaocthongthai.com

Map of Sanders County, Montana Địa Ốc Thông Thái Property Tax Sanders County Montana Check the characteristics of your property with. The treasurer’s office is the collection and distribution center for all taxes in sanders county. The department’s property assessment field offices are responsible for providing the total taxable. While the vast majority of taxes are paid on or. 2024 certified property taxable values. The sanders county assessor is responsible for appraising real estate. Property Tax Sanders County Montana.

From www.countryhomesofamerica.com

21.04 acres in Sanders County, Montana Property Tax Sanders County Montana Stage two fire restrictions for sanders county is in effect. Stage two fire restrictions in effect. While the vast majority of taxes are paid on or. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. Below, we’ve provided direct links to property tax lookup resources for all montana. Property Tax Sanders County Montana.

From www.realtor.com

Sanders County, MT Real Estate & Homes for Sale Property Tax Sanders County Montana Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. Check the characteristics of your property with. The treasurer’s office is the collection and distribution center for all taxes in sanders county. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in. Property Tax Sanders County Montana.

From www.realtor.com

Sanders County, MT Real Estate & Homes for Sale Property Tax Sanders County Montana The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. Check the characteristics of your property with. Stage two fire restrictions in effect. The treasurer’s office is the. Property Tax Sanders County Montana.

From www.landwatch.com

Plains, Sanders County, MT House for sale Property ID 337111929 Property Tax Sanders County Montana Stage two fire restrictions in effect. Stage two fire restrictions for sanders county is in effect. The treasurer’s office is the collection and distribution center for all taxes in sanders county. Check the characteristics of your property with. The department’s property assessment field offices are responsible for providing the total taxable. Below, we’ve provided direct links to property tax lookup. Property Tax Sanders County Montana.

From www.landwatch.com

Trout Creek, Sanders County, MT House for sale Property ID 338412044 Property Tax Sanders County Montana Check the characteristics of your property with. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. Stage two fire restrictions for sanders county is in effect. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. 2024 certified property. Property Tax Sanders County Montana.

From www.sportsafieldtrophyproperties.com

United States of America, Montana, Sanders, Vacant Land For Sale Property Tax Sanders County Montana 2024 certified property taxable values. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. Check the characteristics of your property with. The treasurer’s office is the collection and distribution. Property Tax Sanders County Montana.

From www.landwatch.com

Plains, Sanders County, MT Farms and Ranches, Homesites for sale Property Tax Sanders County Montana Check the characteristics of your property with. To access your property information, enter a property number, assessment code, name, or address in the search box above. Stage two fire restrictions in effect. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. While the vast majority of taxes are. Property Tax Sanders County Montana.

From www.whereig.com

Map of Sanders County, Montana Where is Located, Cities, Population Property Tax Sanders County Montana The department’s property assessment field offices are responsible for providing the total taxable. The sanders county assessor is responsible for appraising real estate and assessing a property tax on properties located in sanders county,. Stage two fire restrictions for sanders county is in effect. While the vast majority of taxes are paid on or. The treasurer’s office is the collection. Property Tax Sanders County Montana.

From www.landwatch.com

Plains, Sanders County, MT for sale Property ID 415205066 LandWatch Property Tax Sanders County Montana The treasurer’s office is the collection and distribution center for all taxes in sanders county. Below, we’ve provided direct links to property tax lookup resources for all montana counties that offer an online service. The median property tax in sanders county, montana is $1,106 per year for a home worth the median value of $172,500. Stage two fire restrictions in. Property Tax Sanders County Montana.